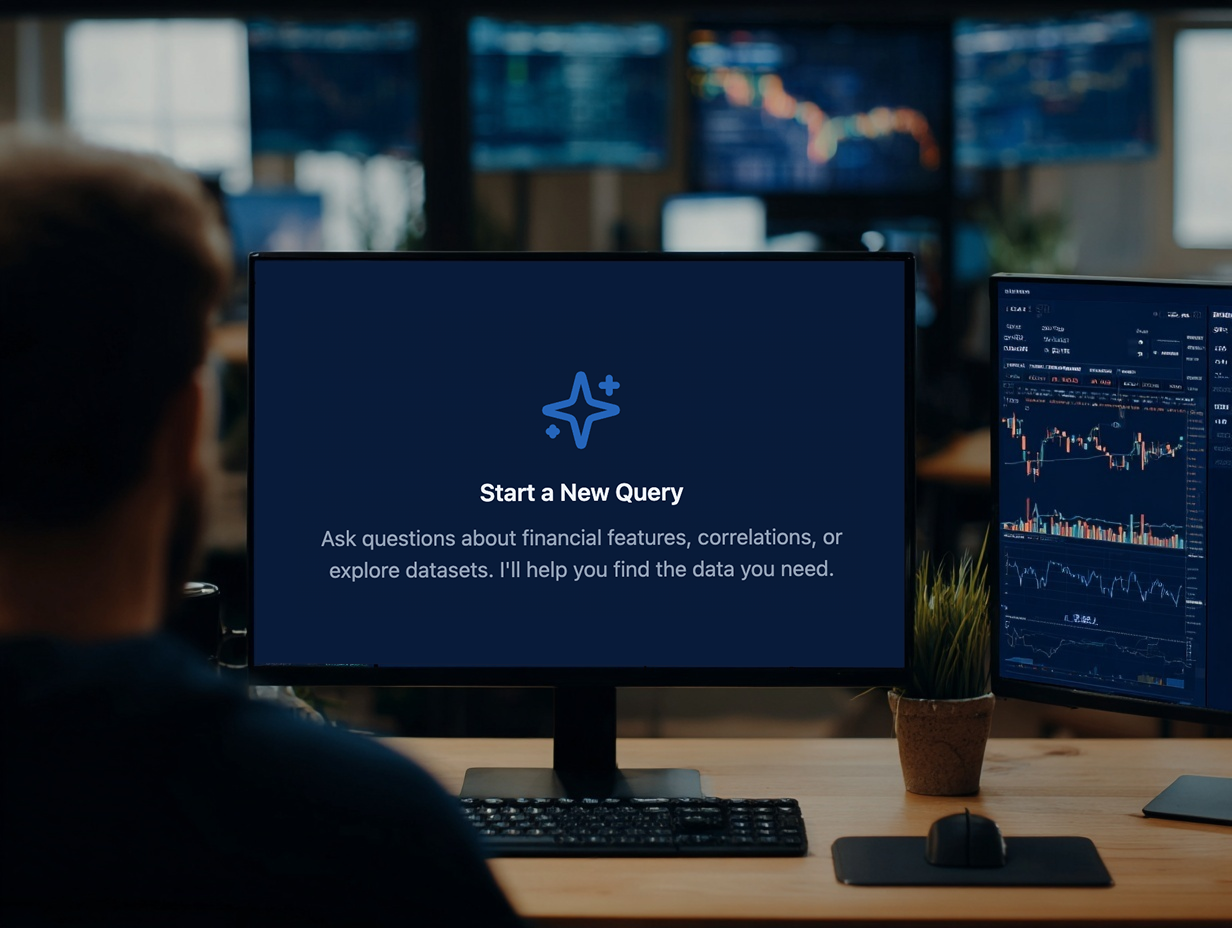

Quanted launches AI data discovery platform for buy-side front-office and data teams

NEW YORK, Nov. 10, 2025 (GLOBE NEWSWIRE) -- Quanted launches its natural language data discovery platform, which allows investors to query Quanted’s data lake and identify which vendor datasets are relevant to their specific investment ideas and research papers before committing resources to data trials, giving funds a faster route to validation while creating a new realm of opportunity for competition among large and emerging firms.

Following a successful beta phase, Query is now launching publicly with early adoption from four of the world’s top ten quantitative funds.

Earlier this year, leading industry reports spotlighted Man Group’s efforts to automate its quantitative research pipeline with agentic AI. Quanted’s new platform extends similar efficiency gains to the broader buy-side community, enabling secure testing of paywalled data that was previously inaccessible without upfront resource commitments. Users can interrogate the world’s paywalled data in one central environment using natural language, or map this data to investment theses and research papers they need to stress-test. These inputs are broken down into quantifiable assertions that drive investment decisions. They are then run against Quanted’s data lake, built from historical fundamental, market, and alternative data licensed from partner vendors and engineered for maximum economic relevance. The output is a ranked list of the most relevant data, with reasoning as to why each specific recommendation relates to the unique use case.

“The launch reflects growing demand from funds that want to understand what data can add value to their trading and investment processes before committing resources to trials with vendors,” said David Forino, Co-founder and CTO at Quanted, who previously led AI research at Volkswagen’s autonomous vehicle division. “Our platform maps a firm’s use cases to relevant datasets inside a secure environment, giving teams the opportunity to validate trading decisions worth billions of dollars much earlier in their workflows.” The company works with funds representing over $100B in combined AUM.

Buy-side teams can deploy Quanted’s products either on-premises or securely in the cloud, depending on their workflow and compliance needs. Users receive a concise output naming and explaining the most relevant data for their use case, along with the evidence supporting each suggestion. When a user proceeds with a referral and licenses a dataset from the vendor, Quanted provides the corresponding ingestion and data-engineering code, along with configuration guidance to accelerate onboarding and validation from weeks or months to days. Vendor IP is protected throughout the entire process, enabling the testing to happen before vendor-user contracting without risking security.

Sign-ups to the natural language data discovery platform are now available here. Demos and pilots are open to hedge funds, quant teams, discretionary managers and data teams seeking access.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/46877f7b-6af9-433b-8998-013200c083f7

Media contact:

press@quanted.com

US: +1 (332) 529-3006

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.